When looking at current market statistics, it is important to always keep in mind “normality VS exception”, while comparing everything to the same period of a previous year. This will allow a de-dramatization of the situation. For example, when we look at the current interest rate, and we compare it to the pandemic market one, we must keep in mind that the 2022 market was not the norm. Rates of 1.99% are far from being the “norm”.

Although the number of properties on the market remains historically low (especially condominiums), sales remain strong and are well above the historical average for the month of June. Despite everything, the prices of single-family properties are stabilizing, recording their weakest increase for the month of June since 2017. Charles Brant, director of the APCIQ’s Market Analysis Department, reminds us that “the number of sales is still comparable to the best years for a month of June, which translates into excellent absorption of the inventory of properties for sale and the maintenance of market conditions that are always to the advantage of sellers”. Still according to him, “this more linear evolution of prices helps to stimulate sales and proves to be a guarantee of buyer confidence in this market, in all property categories.”

Let’s take a look at the statistics for the month of June 2023, freshly released, in comparison with the month of June 2022.

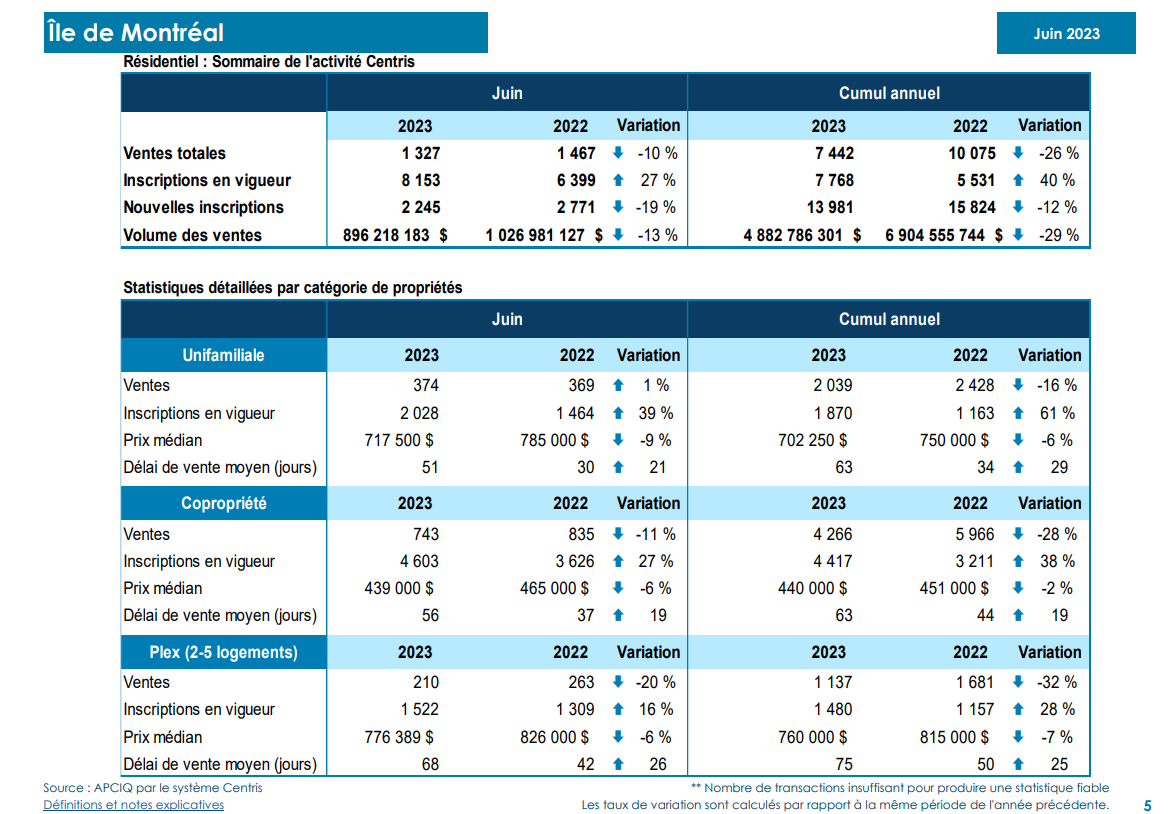

Montreal

For the Montreal region, at the level of single-family residences, we can notice an increase in sales of 1%, with an increase in the number of active listings of 39%; the median price of these fell by 9% while the average selling time rose by 21 days. For condominiums, the decrease in sales is of 11%, despite a 27% increase in the listing rate; resulting in a 9% drop in median prices. The average selling time in this case increased by 19 days. As for plexes, they experienced a 20% decrease in sales, despite a 16% increase in the number of listings. The median price drop, in this case, was 6% and the average selling time increased by 26 days.

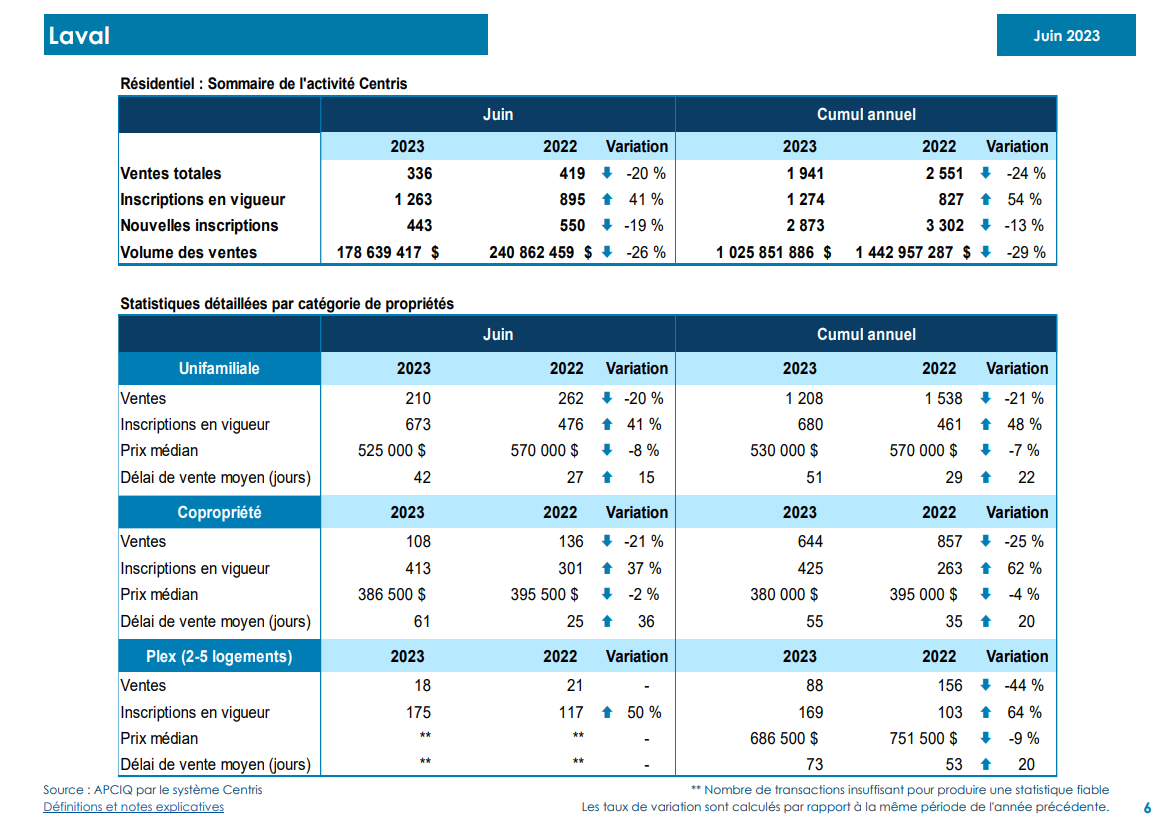

Laval

For the Laval region, at the level of single-family residences, we can notice a decrease in sales of 20%, with an increase in the number of active listings of 41%; the median price fell by 8%, while the average selling time rose by 15 days. For condominiums, the decrease in sales goes up to 21%, despite a 37% increase in the listing rate; resulting in a 2% drop in median prices. The average selling time in this case increased by 36 days.

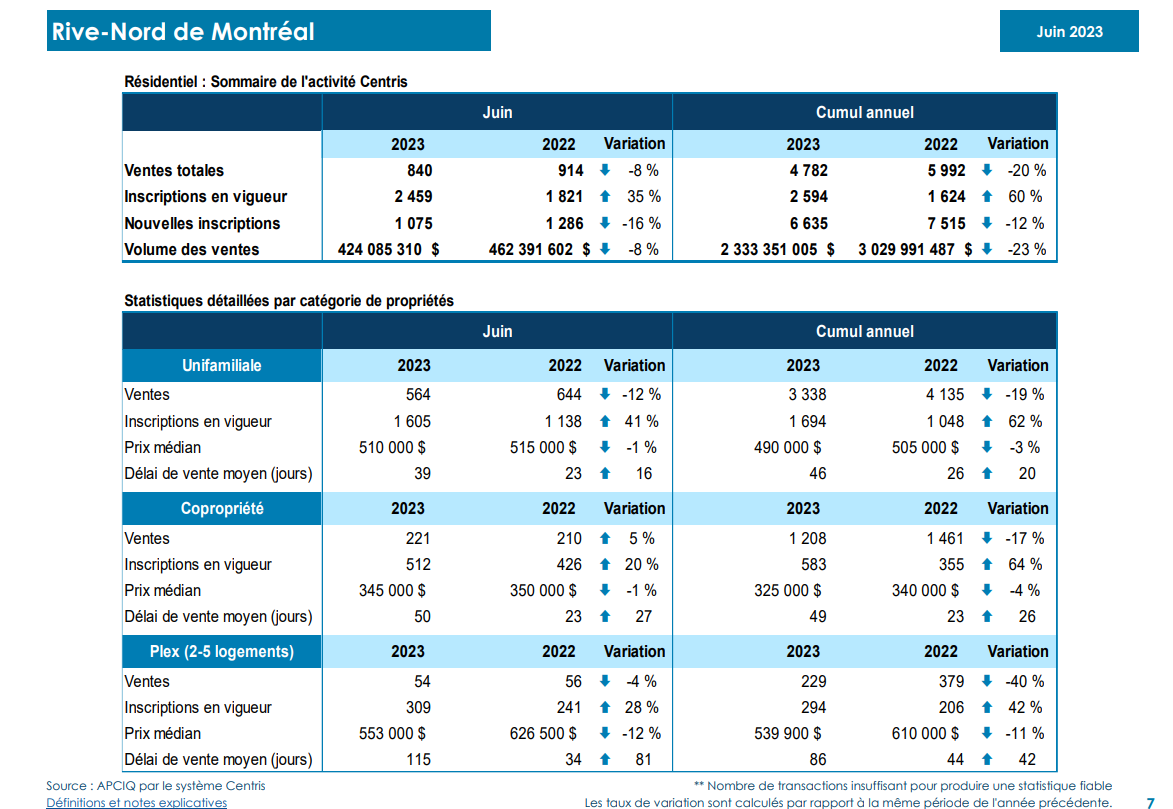

North-Shore of Montreal

For the North-Shore of Montreal, at the level of single-family residences, we can notice a decrease in sales of 12%, with an increase in the number of active listings of 41%; the median price fell by only 1%, while the average selling time increased by 16 days. For condominiums, there is an increase in sales of 5%, and an increase in the listing rate of 41%; despite this, we have a drop in median prices of 1%. The average selling time in this case increased by 27 days. As for plexes, they experienced a 4% decrease in sales, despite a 28% increase in the number of listings. The median price drop, in this case, was 12% and the average selling time increased by 81 days.

As mentioned earlier, it is important to keep in mind that in June 2022 prices were not within the norm. With the exception of interest rates, our market is simply normalizing, before continuing to grow at a normal pace. That’s just the real estate cycle.